Get your loan in 3 simple steps

A Personal loan is a form of credit offered by financial institutions for the borrower’s personal use. It is an unsecured loan and doesn’t require collateral as security or a guarantor to avail the loan.

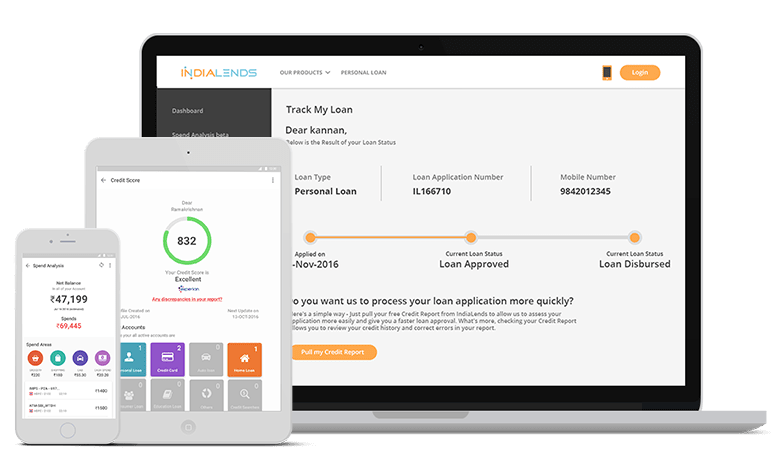

- Register 2 min Apply online in less than 2 minutes

- Quick Verification in 1 hr We will review your application and give you a decision within minutes

- Receive Fund in 3 days You will be receiving your Cash within few days

Our Partners

Personal Loan

A personal loan is a collateral-free credit facility extended by Banks and NBFCs to salaried and self-employed individuals. IndiaLends is the largest online personal loan provider in the country, having helped over a hundred and fifty thousand customers. Over 35 Banks and NBFCs have tied-up with IndiaLends to provide personal loans to varying customer profiles. Below, we've mentioned some of the key features of an easy personal loan you can get through IndiaLends.

Personal Loan interest rate

Interest rates can vary based on the customer profile. Loan rates start at about 10.99%. To increase your chances of getting a low- interest rate loan, an individual should have a good credit history. Ideally, a CIBIL score greater than 750 is considered a good score.

Personal Loan tenure

The tenure period of a Personal Loan starts from 3 months and goes all the way up to 6 years. The choice of tenure is usually left up to the borrower. Depending on his need – short-term or long-term - borrower can ask for a tenure that suits his needs. The only thing to keep in mind is that the EMI (Equated Monthly Instalment) should be an amount which you can pay back easily every month.

Documents required for a Personal Loan

Before disbursing the loan, financial institutions usually ask for documents like ID proof, address proof, PAN card copy, salary slips, latest bank statements, photo, ECS mandates and post-dated cheques.

Personal Loan with zero pre-payment fee

Some NBFCs allow customers to either entirely pay the loan amount or part pre-pay the principal on the loan. There are usually some terms and conditions attached to such pre-payment. For example, pre-payment is only allowed after 12 months and pre- payment fee might be charged on the amount being repaid. However, this varies from product to product and should be clarified at from your lender before disbursal.

Low-interest personal loan

As discussed earlier, personal loan interest rates can vary depending up on the customer’s profile. IndiaLends’ algorithms try to get the lowest possible interest rate product for the customer.

Personal Loan from banks

Banks are RBI registered organisations that are responsible for activities like deposit taking, lending, etc. A recent change made by the RBI was the introduction of payment banks and small finance banks in addition to universal banks. Only universal banks and small finance banks can lend to individuals. Applying with IndiaLends is the easiest way to get a personal loan from the top banks in the country. IndiaLends has tied-up with most of the reputed Banks and NBFCs like HDFC, ICICI, RBL, IndusInd, Kotak, etc.

Personal Loan from NBFCs

NBFCs are RBI registered lending companies that are mostly not allowed to take customer deposits and are especially setup for lending to individuals and businesses. NBFCs borrow the money from Banks for lending, therefore the interest rates on Personal Loans tend to be higher than Banks. Moreover, NBFCs lend to higher risk profile segment and thus have a higher acceptance rates.

Private financing

It is advisable to get a personal loan from an RBI regulated entity like a Bank or an NBFC. Because they are governed by RBI rules, the practices of these organisations tend to be fairer from both, interest rates and collections perspective. The other big advantage is that these companies report loan performance back to CIBIL, Experian, Hi-Mark, etc. This means that your credit score will improve when you make timely payments so that you can get cheaper loans in future.

Self-Employed Personal Loans

Self-employed individuals like traders, shop owners, small businessmen can apply for personal loans at the IndiaLends’ website. NBFCs and Banks ask for a different set of documents in such cases. Documents like home/office ownership proof, Income tax return (ITR), business stability proof, etc. are required in most cases. In cases where the credit profile of the applicant is very good, customers can get a loan with minimum documentation.

No salary slip Personal Loan

Most financial institutions ask for a salary slip for each of the last 3 months. Some individuals who do not get salary slips from the company they work for, are usually not able to get a loan from a Bank or an NBFC. IndiaLends is able to help such customers to get loans from NBFCs because of a number of specialised tie-ups.

New to Credit loans

While CIBIL and Experian have records for over 150 million individuals, a vast majority has still never borrowed from an RBI regulated (Credit Bureau member) financial institution. This means that none of them have a credit bureau record and therefore no credit history and credit score. Also, because these individuals do not have a credit file, they find it difficult to get a loan from financial institutions. IndiaLends is able to help some new to credit (thin file) customers get access to low interest personal loans through the unique partnerships it has with various Banks.

Recently declined Personal Loan application

Most of the consumers who apply for a loan with a Bank get declined because of reasons like poor or no credit history, low affordability, not enough supporting documents, etc. IndiaLends is able to help some of these customers get affordable loans from specialised NBFCs.

Bank and NBFC partners

IndiaLends has tied-up with almost all lending institutions, large and small. HDFC, ICICI, SBI, Kotak, IndusInd, Tata Capital, Bajaj Finserv, Capital First, IIFL, IndiaBulls, RBL Bank, DHFL, Aditya Birla Finance, American Express, etc. are some major banks of the country we have tied up with.

Loans for phones / desktops / laptops and tablets

For customers looking to buy the latest gadgets, be it an iPhone 7 or the Macbook Pro, IndiaLends provides easy installment personal loans with loan amounts as small as Rs. 25000.

EMI without Credit Cards

E-commerce marketplaces allow easy EMI options on a number of large ticket purchases, but this is restricted to customers who already have credit cards. The proportion of people getting such benefits is still small at about 10 million people throughout the country. IndiaLends' online personal loan is an easy way to quickly make large ticket purchases on e- commerce portals and convert into EMIs.

Credit Report

A credit report is like your financial report card that contains historical data about all the loans and credit cards of an individual. The type of loan accounts include - Credit Card, Personal Loan, Home Loan, Gold Loan, Car Loan, Two Wheeler Loan, Overdraft, Loan against property, Agriculture loan, etc. Each account has detailed information about the repayment history, amount of loan, tenure of loan, open date, close date, etc. This information is used by the Credit Bureau to determine the risk rating of an individual. This risk rating is called the credit score. The credit score ranges from 300-900. The higher the score, the higher would be the chances of getting a loan. India has 4 credit bureaus that provides credit scores to individuals viz. CIBIL, Experian, Equifax and Hi- Mark. IndiaLends has tied-up with the Experian and the Hi-Mark credit bureaus to provide free credit reports and analysis to its customers. Along with this, IndiaLends customers also get free credit report refreshes every quarter for the first 12 months.

Google Play

Google Play